South Africa has turned into a tough operating environment for big local networks, with Vodacom and MTN bleeding subscribers over the past six months.

This is not to mention the serious problems faced by Cell C, which was struggling to pay its roaming bills to MTN and resorted to signing a revised agreement with its roaming partner.

These problems have been attributed to numerous factors, including the state of the South African economy which has resulted in reduced consumer spending.

The real reason major operators like MTN and Vodacom are losing customers and revenue, however, is the implementation of new regulations by the Independent Communications Authority of South Africa (ICASA) designed to protect consumers from predatory out-of-bundle (OOB) spend.

These rules require mobile operators to block OOB billing by default and to charge rates comparative to in-bundle fees when subscribers do opt-in to OOB billing.

A considerable portion of both MTN and Vodacom’s revenue originated from OOB billing, and these new regulations have subsequently begun to somewhat stifle these networks’ growth.

Leaders Decline:

Vodacom’s recently-published trading update for the period ended 30 June 2019 showed a decline in service revenue of 1.2% compared to the previous year.

The company also recorded a loss of 500,000 data customers, which it attributed to the new regulations.

MTN said it grew its postpaid user base (including telemetry customers) by 100,000 over the first half of 2019, but it dropped around two million prepaid customers over the period.

Speaking at the company’s results presentation, MTN Group CEO Rob Shuter explained that this subscriber loss was partly due to the OOB data pricing changes required by ICASA regulations, as well as the discontinuation of one of its popular products.

“We have had a challenging first half in South Africa,” Shuter said. “We had our famous 1GB promotion, which we decided was not generating value and we pulled it out of the market.”

“A lot of those SIMs have since become dormant and contributed to the drop in prepaid users,” he said.

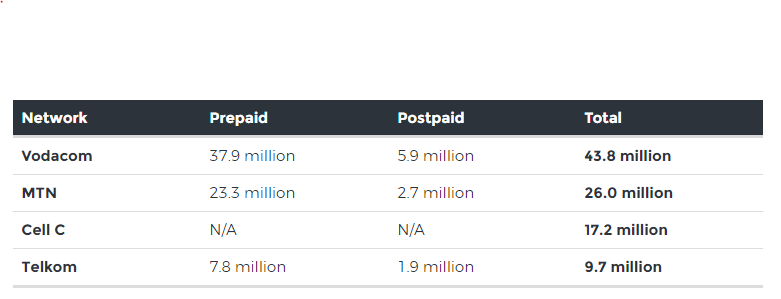

We compared the real customer base of Telkom, MTN, Vodacom, and Cell C according to their latest published trading results. Telemetry subscribers were excluded from the comparison.

Mobile Subscribers:

Vodacom’s trading update for the quarter ended 30 June 2019 shows it now has a total of 43.8 million customers in South Africa, comprising 37.9 million prepaid and 5.9 million contract customers.

MTN’s interim results for the period ended 30 June 2019 reflected that it has a local mobile subscriber base of 29.2 million subscribers, which works out to 26 million customers after deducting the operator’s telemetry subscribers.

Cell C’s latest financial results reflect 17.2 million South African customers.

Telkom’s financial results for the year ended 31 March 2019 showed that it had a total of 9.7 million mobile subscribers.