Vodacom on Monday (13 May) published its annual financial results for the year ending March 2019, showing a decline in the number of data users in South Africa – but a boost in data revenue.

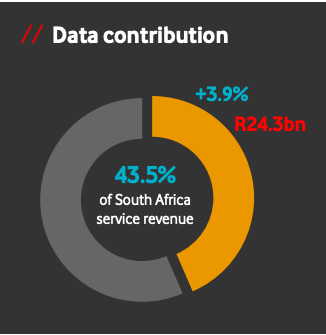

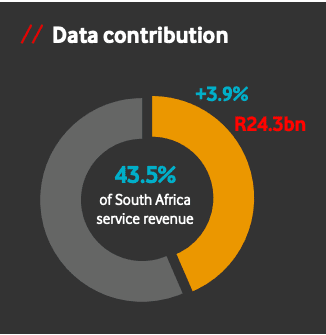

South African data revenue grew by 3.9% to R24.3 billion, contributing 43.5% to service revenue. However active data users in the country decreased slightly from 20.35 million customers in 2018, to 19.95 million in 2019 – a drop of almost 2%.

Despite the drop in users, the group said that overall data usage drivers were encouraging, noting that data traffic was up 35.6%.

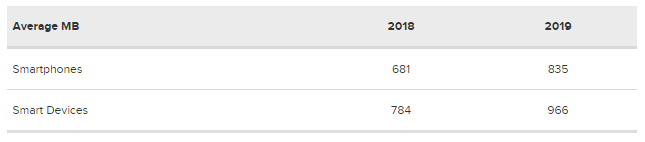

Active smart devices on the Vodacom network were up 7.6% to 19.9 million, of which 10 million are 4G devices. Average usage on these smart devices has improved 23.2% to 966MB, the group said.

The group also noted that data bundle purchases have also increased by 13.1% to 866 million.

“Our platform strategy, designed to stimulate reasons to consume data, is gaining momentum. Take up of the video play service is encouraging with 869,000 active users on the platform.

“Our music platform, My Muze, is steadily gaining customers, and our gaming platform PlayInc. has now been launched,” the group said.

Data prices

The topic of data prices in South Africa has been coming up regularly in the past few years, leading to a push from regulatory authorities to force mobile networks into action.

The Independent Communications Authority (Icasa) in February introduced new end-user regulations which forced operators to clamp down on out-of-bundle charges, giving consumers more power to control how much money they were spending on data.

The Competition Commission, meanwhile, is conducting a review on data prices in the country, having already released a preliminary report showing that local costs are far higher than international standards.

Vodacom CEO Shameel Joosub said that the group has responded to the public call for lower prices as well as the directives from regulatory authorities on the matter, by reducing out-of-bundle tariffs, which have “contributed to the 37% decline in effective data prices since the end of March last year,” he said.

“This translates into a further R2 billion in savings enjoyed by customers as part of our ongoing pricing transformation strategy. Over a three-year period, data prices have fallen by 57%; despite not having access to further available spectrum.”

According to Vodacom, the effective price per MB has reduced 23.3% following the implementation of the Icasa regulations in March, as well as a further out-of-bundle rate reduction of 50%.

Previously, Vodacom said that most significant obstacle to reducing input costs and, by extension, data prices in South Africa is the fact that no new spectrum has been allocated in the last 14 years.

“Lengthy delays in completing the digital migration and allocating 4G spectrum has curbed the pace at which data prices could have fallen,” Vodacom said.

High demand spectrum – or what is often referred to as the ‘digital dividend’ spectrum – is in the 700-800mHz band and can only be allocated once the digital migration in South Africa is completed, it said.

Republished Article: This article was originally published by a staff writer- https://businesstech.co.za/